Special edition: "Pre-commerce"

By Tofino Capital

The Realistic Optimist is a paid newsletter covering the globalized startup scene.

Paid subscribers include readers from Endeavor, Sturgeon Capital, 500 Global, Quona Capital and more.

Its work has been re-published by other tech publications such as Maddyness UK, Tech in Asia and TechCabal.

Special edition

This special edition is an excerpt from a fascinating memo, courtesy of Tofino Capital. Tofino invests in tech startups in frontier markets. You can read the full memo here.

Notably, Tofino invested in CAAFiSOM, Somaliland’s first VC-backed startup.

This memo explores how one should think about investing in e-commerce in markets where e-commerce doesn’t yet exist.

The Realistic Optimist did not receive any remuneration for sharing this report. It’s just really interesting.

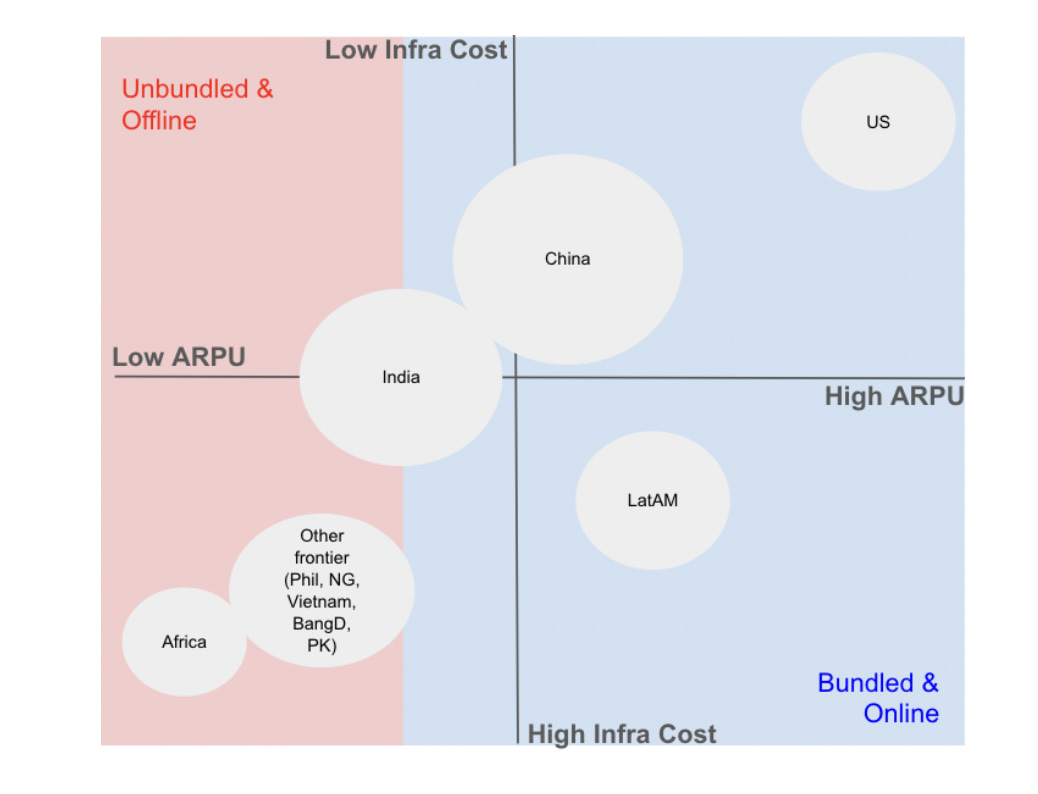

Tofino’s “Infra-x-ARPU pre-commerce matrix”

Like most investors, we presume that e-commerce will continue to spread and eventually take hold in all markets in a pattern similar to the pioneering top 10 markets. But we’re not interested in investing “eventually” — we want to know where to invest now to get ahead of the e-commerce wave. Tofino’s core markets have e-commerce penetration rates that are relatively low (<10%), with much of economic activity still taking place in the informal sector–in cash and offline.

We call these “pre-commerce” markets, and the various models that succeed, the inflection points for adoption/usage of platforms, the products, and payment rails that drive sector-specific metrics are very different just before widespread adoption.

Fundamentals of pre-commerce

Most investors have invested in e-commerce because they believe it’s inevitable. The data shows that when a specific demographic reaches certain disposable income thresholds, they prefer to buy online. The assumption is that it’s easier and simpler to do that, hence the widespread adoption. However, there is limited data on the kinds of platforms that succeed in “pre-commerce” contexts, where things are a little “messier.”

While simple financial products might be suitable for consumers in mature e-commerce markets, those that do well in pre-commerce, often look very different: they offer consumers who face volatile incomes, irregular cash flows, and diverse financial priorities a vast array of different transaction capabilities. They offer optionality at the expense of simplicity, practicality at the expense cost (such as online/offline rails) and social status/prestige as a mainline feature.

When considering where and how to invest before widespread e-commerce adoption, we’ve been inspired by a few books, best summarized by Clayton Christenson’s “Jobs to Be Done” (JTBD) theory, the book Portfolios of the Poor, an Old Testament-type book for Tofino Capital published in 2009, and Africa Works, a 25 year old book by Patrick Chabal and JP Daloz, that explores how Africa’s modernization was (and is) progressing rapidly, just not in the way developed market stakeholders anticipated.

- Trust and consumer ambition matter more than ease

The JTBD theory suggests that we focus too much on understanding macro consumer movements, such as the correlations between decisions, income, age, etc. The problem is that there are not enough micro-decisions that repeatedly reveal themselves when people choose to transact. As we discussed and researched more, we found the same. The macro correlations were somewhat obvious: people seek easier ways of transacting and e-commerce does represent an easier way to transact.

However, we found that in most of our markets, it was not ease of transacting that onboarded people to platforms– many consumers employ trusted house staff that do all the shopping for them at the local market rather than going themselves. They don't value the staff's time the same way they do their own, and thus the time-saving appeal of e-commerce grocery delivery is diminished. Instead, prestige and brand ambition made them want to transact online. They only leverage a platform if a minimum trust threshold is met. Companies building around brand ambition and trust are much more successful than companies trying to simplify transactions.

- The informal market is complex and must be well-understood

In Tofino markets, the informal sector constitutes well over 50% of GDP and absorbs 11 million of the 12 million Africans who turn 18 every year. We think the reason why some markets–Nigeria in particular–remain so resilient in the face of very challenging macroeconomic headwinds is because the informal sector is so large (perhaps double or triple formal economic activity) and vibrant.

Some parts of informal markets are inefficient and some are not. If you are hungry and stuck in traffic (and traffic is horrendous in cities such as Lagos and Dhaka), it is incredibly efficient and easy to roll down the window and buy food and drink from the street sellers pacing the lanes. The biggest problem with the informal market is the majority of transactions take place in small amounts, inhibiting efficient bulk buying and information flow.

Price discovery has always been easy in Western markets–walking into a supermarket or searching online allows consumers to compare prices and find the best deal instantly. In informal markets, information is limited to buyers’ and sellers’ immediate vicinity and network, and middlemen exist in many markets sustained by the margins permitted by inefficient information access. Companies that recognize the consumers' need to get access to price information and be able to search by price can onboard users rapidly.

- Simplicity is the problem, not the solution

Another key component of understanding emerging market consumer behavior is recognizing how complicated the financial lives of lower-end consumers are and how overly simplistic the (primarily western developed) technology platforms are in servicing them. Most tech-first platforms don't work in frontier markets because they don't mirror the level of sophistication of lower-end consumers’ lives.

The book Portfolios of the Poor makes this point again and again–showing on average the person living on less than 2 dollars a day manages at least five sources of credit, including formal credit from a bank, informal credit from a family member or neighbor, trade credit from a supplier or vendor, community-based credit (often called ROSCAs, rotating savings and credit associations), and asset-based credit, pledging assets such as livestock, jewelry, or property as collateral to secure loans from formal or informal lenders.

But it doesn't connect how to invest with its main thesis: people live rich, sophisticated, complex financial lives, especially if they have limited resources. Not the opposite.

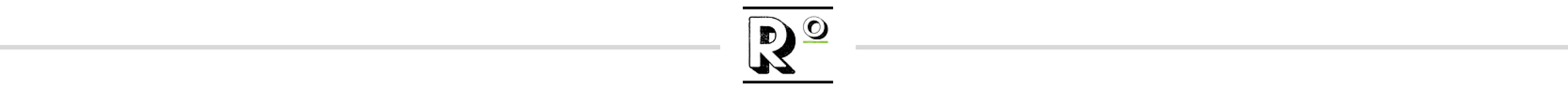

With these principles in mind, we developed a four-part phased progression capturing our understanding of pre-commerce in frontier and emerging markets. Just because formal e-commerce is not widespread does not mean people are not doing business online. Pre-commerce is defined as a do-it-yourself style of e-commerce that addresses the high cost of poor infrastructure, lack of credit card penetration, and low levels of trust in online transactions.

Here is our take on its stages:

Stage 1: Matching

The first stage of pre-commerce can best be understood as peer-to-peer marketplaces that match buyers and sellers but do not offer ancillary services such as payments or logistics. Think Facebook Marketplace or Nigerian digital classifieds provider JiJi. Transactions initiated online are consummated through offline actions, with users often transacting only with friends and then with strangers, but meeting face to face to reduce fraud and check the actual product, identifying a central location to share logistics costs and payments in cash or direct digital payments.

The platform where the matching occurs does not try to address the high logistics cost as the buyer and seller carry those costs. These unbundled transactions constitute most “pre-commerce” transactions in Asia, Latin America, and Africa–a reality accelerated by COVID physical market closures. In this way, the platform does not try to address the fact that there is a low ARPU because the platform makes its revenue from postings and ads.

Emerging market consumers are by far the largest users of Facebook Marketplace. Facebook Marketplace is the world’s second-largest marketplace in monthly active users, behind only Amazon (it’s ahead of Alibaba, Walmart, eBay, and Taobao).

While FB Marketplace was formally launched in 2015, the idea was pitched years before because Facebook started to notice Facebook’s “Groups” were being used primarily to transact among friends in emerging markets. However, because using Facebook as an informal sales channel was not common in developed markets, it was a blind spot for Facebook, and the company never built out the platform as an independent, fully bundled offering.

Key features of stage 1 pre-commerce:

- Low ARPU (Platform makes money off of ads)

- High infra cost (Users absorb the cost of logistics)

- High baseline trust (Users are transacting among extended personal networks but have incomplete market information)

Stage 2: Matching plus payments

The next stage of pre-commerce develops when platforms add a payment feature to their “marketplaces” through which buyers and sellers find each other. This progression elevates the utility of the platform and keeps more of the transactions online. We can track the evolution from stage 1 to stage 2 in the case of Whatsapp– the dominant chat platform in frontier markets.

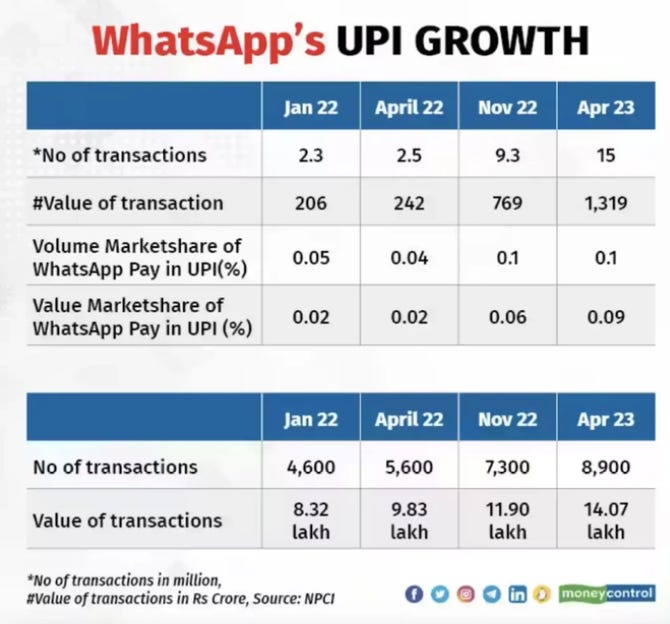

Over 95% of the connected population of Nigeria, South Africa, Brazil, India, and Argentina use WhatsApp at least monthly. Recognizing the Stage 1 “Matching” commerce that was occurring on their platforms, Whatsapp launched a payment service for Indian users in late 2020. Whatsapp Pay lets Indian users send money to anyone's Indian bank account (using India’s unified payments interface, UPI) within a chat conversation. Now, beyond just buyers and sellers finding each other and chatting, they could consummate the payment for the transaction on the same platform where they matched.

It took Whatsapp Pay just two years to reach 100 million users and it has seen remarkable growth since then. A key growth driver in 2022 was the platform's expansion of accepted payment options, expanding its interoperability, a key component of Stage 3 pre-commerce.

Key features of stage 2 pre-commerce:

- Low ARPU (Platform subsidized still)

- High infra cost (Users absorb the cost of logistics)

- High baseline trust (Users are transacting among extended personal networks but have incomplete market information)

Stage 3: Efficient matching plus payments and interoperability

The next stage of pre-commerce increases the sophistication and efficiency of the marketplace while expanding the payment rails available to users (interoperability.) The last five years have seen the emergence of marketplaces that aim to monetize an increasing share of Africa’s large informal market by organizing supply and demand across products and taking a fee on transactions conducted on the platform.

Platforms such as Sabi, Wasoko, and TradeDepot represent various business models at this stage 3 pre-commerce. Some actually get involved in moving products, becoming more of a digital distributor, while others remain pure play asset light marketplaces.

Stage 3 pre-commerce marketplaces allow buyers and sellers to go beyond their social networks to shop around on price more efficiently. Unlike classifieds and Facebook Marketplace that have inventories limited by whatever sellers want to sell at any given time, the marketplaces are organized by searchable product categories sortable by price, which gives the buyers much more market information. Sabi curates suppliers but remains asset-light, avoiding the high costs of storing inventory and managing logistics by not providing delivery. Sabi users can use the platform also to purchase logistics services from on-platform providers.

To overcome the lack of trust in only platforms, Sabi built a human network of agents to act as the offline/online interface for small retail users. As the platforms grow and demand quickly materializes, getting access to a sufficient supply level becomes a challenge and the marketplaces feel compelled to create partnerships with wholesalers and importers.

In the case of Twiga in East Africa, which created a pioneering marketplace for produce, the company evolved into owning and operating its own farms. This transition from an asset-light to an asset-heavy business, while maybe necessary for market growth, requires a new set of more PE-like investors.

Key features of stage 3 pre-commerce:

- Low ARPU (marketplaces seek both volume and bigger buyers over time to offset this)

- High-infra cost (Users absorb cost of logistics)

- Low trust (use of human agent network as offline/online interface) but efficient price discovery for users and curated product offerings.

Stage 4: Efficient matching plus interoperable payments and financial products

The most sophisticated form of pre-commerce in emerging markets adds the defining characteristic of credit into the mix. Sabi has a foot into stage four as it provides credit to buyers and sellers on the platform as the company has strong data on creditworthiness and its users lack access to traditional bank credit products. While customers initially start to use Sabi to search for cheaper-priced products, they stay long-term because of access to credit.

Jumia has also had a long and meandering path to stage four: it has retrenched into being a marketplace for high-ARPU products that offer financing and diverse payment rails. Jumia learned the hard way that logistics is a difficult addition to try and layer onto this fourth stage.

The combination of a curated marketplace, payment options, and credit products makes stage four a phase in which many emerging markets will remain in for many years. This is not a bad thing necessarily– it is simply a reflection of what it takes to serve the complex market conditions present in markets such as Nigeria, for example.

Key features of stage 4 pre-commerce:

- Med ARPU as product curation changes over time

- High-infra cost (Users absorb cost of logistics)

- Increasing trust as the players build brands in the market

True E-Commerce

What comes after stage four is what we would traditionally identify as true e-commerce, which has all of the features of the previous stages plus logistics. This is Amazon, for example. One key takeaway from our research is that you cannot end-run the evolution to true e-commerce. There is a clear order of operations and progression. Jumia tried to jump to true e-com from the start by launching with logistics, then focusing on matching, and now doubling down on payments. Now, they’re working backward by improving matching by reducing skews, reducing their investments into logistics, and focusing on payments.

Our pre-commerce investment thesis

We have established through our analysis that no true e-commerce play exists in our focus markets. Instead, we must look at the investment opportunities throughout the stages of pre-commerce.

In the first few stages of pre-commerce we tend to think the opportunity has passed, the space is too crowded or the platforms are global and listed, and thus not available in private markets. Stages 1 and 2 (“Matching/Payments) investments include things like digital classified companies and peer to peer platforms.

In the case of classifieds, this sector has existed for decades, going back to the 1990s in South Africa. Some of the earliest e-commerce startups were proto-classified sites like Kalahari.com (1998), BidorBuy (1999) and TakeALot (2002). Other classified markets such as West Africa, and in particular Nigeria, created reasonably successful startups (Cheki, Jobberman, OLX) in the early 2010s, but most were not able to evolve up the ladder of pre-commerce because they were pre mobile money. Ringier One Africa Media, backed by a Swiss family, is a notable exception and has managed to make this “pre-commerce” stage profitable in frontier markets (and Europe) in part by acquiring revenue across multiple markets and sectors.

Other opportunities exist in this early stage space in the Whatsapp “skins and interfaces” sector -- companies building on top of Whatsapp payments and groups. The benefit these startups have is access to a massive, already scaled platform. China’s failed efforts to displace Whatsapp in African markets by essentially selling ultra cheap phones with WeChat embedded in the firmware shows just how sticky WhatsApp is.

Even although Whatsapp brings with it immense buyer devotion, the downside is that it limits product variability, and potentially constrains startups’ product led growth plans. Companies such as Yebo Fresh in South Africa used the platform to scale, but ultimately shut down because it couldn’t evolve as fast as its users wanted. New platforms using Whatsapp in non e-commerce sectors, such as JemHR in HR and FoondaMate, offer perhaps better use cases of using Whatsapp–Meta rails for services industries.

Stages 3 and 4 is where we see more interesting, scalable opportunities. This is where nascent true marketplaces emerge. The challenge has always been growing the demand in parallel with the supply - they are almost always unbalanced. This has been the case in virtually every African startup; they generated massive demand, raised in the ZIRP era, but then found themselves in high CAPEX or CAC business models trying to create the other side of the marketplace.

Companies such as Wasoko (valued at $260 million as of December 2023), Twiga (valued in 2021 at ~1bn, but now more likely 200-300m), MaxAB, Marketforce (valued at >100m), Trade Depot (valued at $200 million) all ended up buying the warehouses, the land or themselves (in the case of Wasoko and MaxAB, they merged) to keep their business afloat.

Where we see opportunities emerge is in niche markets where there is high inelastic demand, virtually zero price transparency to non insiders and desperate, high ARPU customers, such as construction supplies (Cutstruct) and chemicals (Matta). Some of the same problems exist (especially in supply side), but the customers are more deep-pocketed.

Ultimately, we think the best way to compete and invest in attractively priced pre-commerce startups is to invest in “enablement infrastructure” that drives up ARPU and drives down infra in an asset light way. These are the picks and shovels of e-commerce, to be sure, but they also give us inexpensive exposure to pre-commerce in a way we wouldn’t be able to achieve by simply investing in payment platforms, whose seed and Series A rounds we tend to be uncomfortable with.

Our initial focus is on three areas that we know well: Ad/MarTech, Customer Success, Fulfillment-tech/Logistics.

1. AdTech

(i) We believe frontier markets will pioneer new ways of accessing customer segments that are non traditional or hard to access. Our investment in Adbot demonstrated this in their partnership with MTN, which gave SME vendors the ability to buy Google Ads with phone credit.

(ii) As e-commerce platforms proliferate in frontier markets, the need for efficient advertising solutions becomes paramount, primarily because of the low ARPU of their customers.

(iii) Targeted advertising solutions tailored to local preferences and demographics can provide significant value to e-commerce businesses seeking to reach their target audience effectively.

2. Customer success platforms

(i) In nascent e-commerce markets, customer acquisition and retention are critical for sustained growth. Customer success businesses that offer services such as customer support, engagement, and loyalty programs play a vital role in driving brand penetration and increased ARPU.

(ii) Our investment in Termii, which helps teams drive repeat interaction with customers through personalized email, voice, text, and instant messages, exposed us to the importance of multi-platform and constant customer engagement to drive ARPU up.

3. Fulfillment technology and asset-light logistics

(i) Efficient order fulfillment is a cornerstone of successful e-commerce operations, but doing it well in places like Bangladesh, which has some of the worst logistics in the world, is infinitely more challenging than Amazon. Our investment in Nuport revealed to us the criticality of this for suppliers as they look to access their consumers more quickly and with less hassle. Our investment in Nuport also gave us access to proprietary market data, revealing interesting consumer trends, brands and demographic preferences.

The Realistic Optimist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice.

Continue your reading with this related piece from The Realistic Optimist:

CAAFiSOM: Somaliland's first VC-backed startup

Timothy Motte • Sep 28, 2023