How Anghami beat Spotify in MENA

By Lara Fakhry

The Realistic Optimist is a paid newsletter covering the globalized startup scene.

It is read by people at Endeavor, Sturgeon Capital, Quona Capital and more.

The Realistic Optimist’s work has been published in Maddyness UK, Tech in Asia and TechCabal.

Author biography

Lara Fakhry was most recently an early-stage consumer tech VC at Origins, and spent the last few years investing in the ecosystem across New York, Dubai and Paris.

Introduction

Over the past two decades, evolutions in tech and consumer habits birthed the music streaming industry. The pandemic cemented its presence, with over 600 million music streaming subscribers accounted for in 2024. Today, the industry is worth $41B and is expected to double over the next decade.

Napster and Pandora first, followed by Spotify in 2006, pioneered the music streaming’s early days. The market was formerly dominated by Apple’s iTunes Store, which had sold 2B songs by 2007. With time, Spotify’s on-demand music choice became a hit. So much so that Apple launched its own streaming service in 2015.

Spotify prevailed. As of 2021, the Swedish company enjoys a comfortable 31% market share. It is followed by Apple Music (15%), Amazon Music (13%), China’s Tencent Music (13%), and YouTube Music (8%).

The Middle East and North Africa (MENA) region is home to a vibrant musical heritage. From Ibn al-Khatib to the Arab-Andalusian genre, to Oum Khalthoum, to Mashrou’ Leila, music holds philosophical, religious and socio-political weight. That makes for good business. Revenues from MENA’s music industry grew 23.8% in 2022, 95.5% of it coming from streaming revenue. This makes MENA one of the industry's fastest-growing global market.

One company, nicknamed “The Spotify of the Middle East”, presciently seized the opportunity.

Anghami backstory

Anghami, “my tunes” in Arabic, was founded by Lebanese duo Eddy Maroun and Elie Habib in 2012. The reader might remember the hassle of primitive music streaming, replete with illegal downloads and MP3 files. A synchronization problem on Eddy’s iPod prevented him from accessing his music. This sparked the desire for a simpler solution.

Between the 1990s and 2000s, industry leaders such as Universal, Sony and Warner were battling online music piracy. In MENA however, independent labels dominated the musical scene. Digital alternatives were scarce, leaving piracy as the only option. By building a regional equivalent to emerging Western streaming services, Anghami wanted to tackle that problem.

Eddy’s musical frustrations merged with Habib’s engineering background to create Anghami, a MENA-focused music streaming app. It grew from there, funded by successive VC rounds.

On February 4th, 2022, Anghami became the first Arab tech company to list on the NASDAQ. The company listed via a special purpose acquisition vehicle (SPAC), on a $220M valuation and a proclaimed 58% of the Middle East’s music streaming market share.

As of Q3 2023, Anghami claims to have over 1.7M paid subscribers. Despite positive financial growth, the company has faced a Nasdaq delisting risk as its stock price fell below the required $1. A situation which has been avoided so far. As of March 2024, you could buy Anghami stock for around $2.

Stock market woes don’t reduce Anghami’s merit. Its paid subscriber base and its regional dominance are impressive, especially in the face of well-funded global competitors. What explains it?

The payment advantage

The Anghami team faced two initial challenges: music piracy and low digital/financial penetration.

In MENA, legal digital offerings accounted for just 13% of recorded music revenues in 2014, compared with 46% worldwide.

Part of the reason for that gap is piracy. Illegal or free Arab music sites, such as Malawy or Nogomistars, beat paid subscription offers. Maroun says that piracy is still the company’s biggest competitor.

Anghami’s launch coincided with regional growth in both internet and smartphone penetration. At the time of Anghami’s founding, the region’s internet penetration rate was around 31%, with significant discrepancies between countries (GCC countries led the way). The rise in internet penetration converged with a rise in smartphone ownership. Anghami decided to start as a mobile app, one of the first in the region.

Despite increasing access to smartphones, subscription-based products were hindered by low banking penetration and even lower credit card ownership. It is estimated that just 14% of MENA’s population had a bank account in 2014. In 2023, only 19% of Iraqis owned a bank account.

It’s difficult for a mobile app to charge money when users only hold cash. To solve this, Anghami partnered with telecom operators, allowing users to pay for their subscriptions through direct mobile billing. The first partnership was with Jordan’s Orange in 2012. Today, if you were to go to one of Anghami’s 40 telecom partners, you would be offered the option to pay for your Anghami subscription at the same time and in the same way as your phone plan. It looks like an added option on your bill, sometimes with added incentives such as a free data package.

This tailored method fosters user loyalty and provides accessible payment options in regions lacking them. From Hallo in Denmark to Virgin Mobile in Kuwait, direct mobile billing remains the payment method for the majority of Anghami’s users.

The cultural advantage

Anghami’s success also lies in its support of Arab artists, both emerging and A-listers. The company understood that it needed to connect with its audience’s preferences. Anghami is a data company: their algorithms deeply understand users' tastes and push content accordingly. Local artists want to do so as well.

Egyptian artist Amr Diab signed an exclusive partnership with Anghami, stating it will allow him to better connect with his fans. Other artists such as Nour Helou and Rami Chalhoub also hold Anghami exclusives. This means that all of their future releases will be available on Anghami only and that a lot of content, though not all of it, has been removed from rival platforms.

Anghami’s library gathers more than 72M songs, of which only 1% is Arabic. Yet, Arabic songs account for half of its traffic. Supporting the region’s artistic scene is a strategic imperative, and they have built a whole ecosystem around it.

For example, Anghami signed a partnership with Groover, a French platform connecting artists to music curators. Anghami is one of the platform’s top curators: it allows artists to send their music to the company and have their team listen to their work.

Anghami also launched Vibe Music Arabia, a joint record label in partnership with Sony. The label will have original Arab music at its core. Rami Zeidan, the former head of TikTok MENA’s Video and Creative division, will lead the creative hub. The first artists to benefit from the project will be Khaleeji producer AbdulAziz Louise and Saudi artist Zena Emad.

Other initiatives such as Anghami Originals and Anghami Studios actively highlight regional talent. This emphasis on curating locally relevant content plays a key role in the company’s continuous regional dominance. In 2022, an Anghami study found that 80% of MENA music streamers considered Anghami as a “distinctive local brand that they feel very close to”.

The loyalty advantage

Anghami’s founders attribute part of their success to moving the company’s headquarters from Beirut to Abu Dhabi. Lebanon’s worsening economic crisis complexified its operations there. In 2020, Lebanon’s share of Anghami’s revenue dropped from 6% to 1%. As unemployment and inflation rates rose, essential state services remained non-existent. Despite their commitment, Anghami’s situation was becoming untenable. But the company chose to stay in the region.

Anghami’s relocation was facilitated by the Abu Dhabi Investment Offices Innovation Programme, a $500M program aimed at attracting businesses to the UAE’s capital. There, Anghami solidified its position as a regional leader reaching a market share of 58% and revenues of $35.5M in 2021. Anghami now has regional offices in Dubai, Cairo and Riyadh.

The relocation maintained Anghami’s distinct “Arabness” while decoupling itself from Lebanon’s woes.

Competition

Anghami started facing competition from Deezer and Spotify in 2018, as both platforms entered MENA. Their services had previously been accessed unofficially through accounts registered in available markets.

Despite their efforts, Anghami still holds around 58% of the region’s market share owing to the previously mentioned payment, cultural and loyalty advantages. Anghami’s dominant position isn’t set in stone though. While Anghami “revolutionized” streaming, payments, presentation, and branding, the majority of content development, production and acquisition is in the hands of pre-digital actors such as Rotana and MBC’s Platinum Records.

Industry leader Spotify is also steadily expanding outside of its core Western markets into the so-called “Rest of World”, which includes MENA. Spotify is putting some marketing budget behind its regional ambitions.

Anghami can’t stand idle. The company merged with OSN+, a video streaming service owned by Dubai-based media group OSN Group. As part of the deal, OSN Group is set to invest $50 million in Anghami building on a $5 million investment made by Saudi Arabia's SRMG last August. The ambition is clear: merge two home-grown companies into a local, digital streaming powerhouse. Put together, OSN and Anghami account for 120 million registered users and 2.5 million paying subscribers.

The music streaming market in the Middle East and Africa is expected to more than double from $1.5B in 2019 to $3.3B by 2027. As the pie gets bigger, global players will want a bite and local actors’ best bet is to join forces.

Conclusion

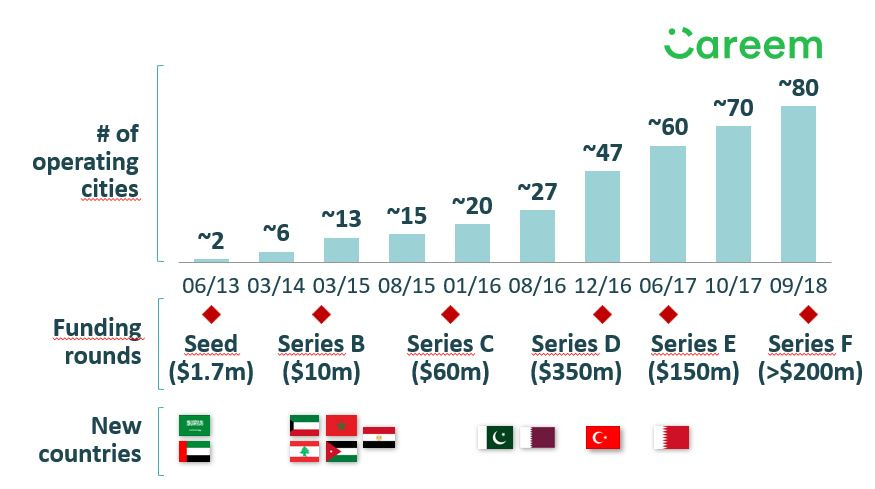

Parallels between Anghami and Careem are clear. Careem launched the “Uber for the Middle East” before eventually getting acquired by it. The bespoke localization approach Careem used to differentiate itself is reminiscent of Anghami.

Parallels are evident in both companies’ adaptability to MENA’s payments and cultural landscape. Careem enabled cash payments (a blasphemy for Silicon Valley) and adapted its product to the region’s gender dynamics. Anghami introduced direct mobile billing and placed big bets on Arab artists.

Anghami’s mimicry might stop at the acquisition step. A perfect copy of the Careem path would imply that the “Spotify of the Middle East” gets acquired by Spotify. Anghami’s OSN merger shows the company chose a different path.

The Realistic Optimist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice.

Continue learning with this relevant piece from The Realistic Optimist:

Careem: MENA's most important startup to date.

Timothy Motte • Oct 20, 2022

The Realistic Optimist provides weekly, in-depth analyses of some of the hottest stories in our now-globalized startup world. Subscribe below to receive it directly to your inbox and don’t hesitate to share it with your colleagues :) Strong foundations

Read full story →