Daba: The company building Africa's investment OS

By enabling anyone to invest in Africa's capital markets, Daba seeks to open up global flows of capital to the continent's innovators.

The Realistic Optimist provides weekly, in-depth analyses of the most relevant stories in our now-globalized startup world. Subscribe below to receive it directly to your inbox and don’t hesitate to share it with your colleagues :)

Unclogging Africa’s investment bottleneck

Investing in Africa is hard. The continent’s fragmentation, split 54 ways to be exact, makes it quasi-impossible for a non-professional investor to get involved. Africa does have the stock markets and the startups to invest in, but the infrastructure to do so remains lackluster.

Let’s take the journey of investing in an African stock market for example. You would need to find an institution enabling you to invest, locate a broker-dealer that can execute the trade, and file the paperwork you need to be allowed to participate. Investing in Africa is currently unfeasible for the average retail investor who checks their stocks on the metro to work.

This reality didn’t sit well with Boum III Jr and Anthony Miclet, our two protagonists for today’s story. Boum, originally from Cameroon, worked at Nasdaq as a software engineer for 5 years and founded his own travel tech startup on the side. Anthony spent his childhood in Africa and started his career at Coca-Cola while founding a food startup in his free time. In the midst of the pandemic, both youngsters joined forces to launch Afrika Startup Lab, a non-profit aimed at providing advisory, education, and community to African entrepreneurs.

In September 2021, the pair decided to take their engagement with the continent one step further by founding Daba, a platform building Africa's full-stack, multi-asset investment infrastructure. In other words, Daba is making it easier to invest in Africa’s different asset classes.

As it stands today, Daba is aimed at the African diaspora in North America and Europe. Benefitting from greater disposable income than their Africa-based counterparts, many members of the diaspora have an inherent connection to their homeland. Daba wants to channel that connection into investments back home, by building the rails to do so.

Retail investors: a deliberate choice

Intuitively, retail diaspora investors aren’t the most evident choice when trying to stimulate investment in African companies. Wouldn’t it be easier to start a VC fund and find a couple of high-net-worth individuals able to irrigate it? To that confrontation, the Daba founders categorically reply that Daba’s goal is more than just getting money into Africa’s capital markets. The platform’s objective is to build the continent’s investment operating system, facilitating capital flows into African companies for decades to come.

Coupled with that dignified mission is also the hard fact that high-net-worth individuals already have the tools to invest in Africa, the fictional venture capital fund being a case in point. On the other hand, retail investors are still unable to simultaneously play a role in and get a piece of Africa’s economic growth story.

This all lays the groundwork for Daba’s raison d’être: democratize investment into Africa’s different asset classes by building the infrastructure to do so. Its name, which stands for “Democratizing Access to Business in Africa”, fully encapsulates the spirit.

Daba: the product and the roadmap

Daba launched its app a couple of months ago, sporting 1,300 users at the time of writing. Led by Anthony’s product management background, the Daba app seeks to combine two worlds: the novel experience of investing in African companies with contemporary social investing features.

Daba plans to gradually increase the number of asset classes available on the app. As of now, Daba users can invest in a curated list of vetted, pre-seed to Series A African startups. Recently, users got a taste of Daba’s new functionality by getting a shot at investing in Orange Côte d’Ivoire’s IPO on the Francophone West African regional stock exchange, BRVM. Daba is reportedly planning to open up investments in companies listed on other African stock markets later this year.

The previously mentioned social investing aspect is omnipresent throughout the app. Users can join so-called “Circles” in which users aggregate to discuss investments in a particular company. In certain cases, the company’s founders participate in Q&A sessions directly in their own Circles, leaving a publicly available trace of relevant information potential investors could find interesting.

In line with a desire to cater to each user’s needs, Daba also wants to enhance the personalization of its product, building personalized portfolio recommendations based on each user’s preference. The company’s SEC investment advisor license bounds it to do so in its users’ best interest.

The content and intelligence axis

I was lucky to speak to Boum and Anthony a couple of weeks ago to catch up on Daba’s progress and get some insights into what they’ve learned so far. One of the most potent points to come out of our conversation was the following: user education.

As stated throughout this article, Daba is truly pioneering what hasn’t been done before: enabling retail investors based in the West to invest in African companies. The challenge is two-fold: not only do many retail investors need investment guidance to start with, but they need it even more when dealing with an unfamiliar market. For a retail investor whose only experience has been Robinhood trading, it might be counter-intuitive to them that their investment into a startup will be illiquid for the next couple of years.

This seems to be one of Daba’s main strategic axis for the year to come: produce, aggregate, and distribute content aimed at informing their users about the continent’s business landscape and startup investing fundamentals.

To that effect, Daba has stepped up a notch in the content space, following the realization that the need for strategic and practical intelligence on the African startup market was still dire. This content push comes in multiple forms, including a newsletter, a burgeoning Youtube channel, and research on the markets it seeks to serve.

Surprises and worries

Out of the inevitable surprises that happen after a product’s launch, one of the most interesting ones for the Daba founders was the interest local Africans showed in the app. While aimed at the African diaspora, people in Africa also signed up to Daba with a real will to learn and figure out how to invest. To the founders, this translates the encouraging finding that Africans believe and want to be an integral part of their continent’s growth story.

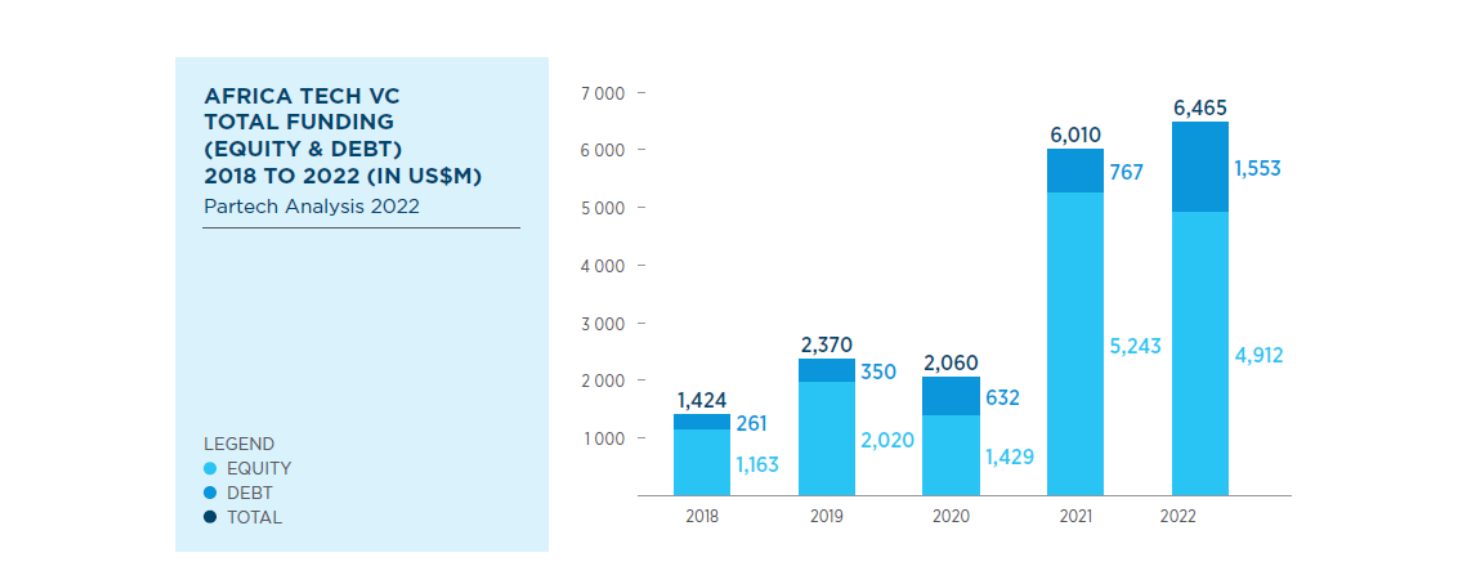

When prompted about what keeps them up at night, Boum and Anthony mentioned the stagnation of Africa’s growth as a source of worry. While it is hard to form a cogent economic growth analysis for a continent spanning 54 disparate countries, an overall slowdown in Africa’s growth would decrease Daba’s attractiveness and subsequent survival chances. A lot will have to happen for that pessimistic vision to be vindicated, with the African VC market continuing its year-over-year growth in spite of global market downturns.

How it works: regulation and why it hasn’t been done before

There’s a reason that a service similar to Daba hasn’t existed up until now. It’s a tough regulatory play, involving multiple stakeholders from Delaware to Abidjan. A fair amount of legal engineering is required, with each asset class having different constraints and rules.

The overarching factor to understand here is that the regulations Daba has to abide by are two-fold: it has to comply with regulations in the investor’s country as well as regulations in the company’s country. The paperwork, licenses, and brunt administrative will it takes to do so largely explain why an app similar to Daba hasn’t existed up until now.

Looking forward: the vision

While the figures are confidential, Boum and Anthony confirmed that some of the companies listed on Daba have received funds. The train has left the station. The company’s roadmap is clear and can be divided into three parts: educate users, add more investment options, and simplify the app. Armed with a hybrid team based in the US and Africa, Daba is at the execution stage.

On a personal note, I do see the founders as visionaries. They could’ve taken an easier path and started an angel investing syndicate, doing their small part for the African tech ecosystem. Rather, Boum and Anthony are deep into SEC filings, African stock exchange paperwork, and relentlessly answering every question posed on Daba’s “Circles”.

Having met Boum in person and having spoken to Anthony multiple times now, one trait comes out: they are ready to put in the effort and are set on laying the sometimes soulless but crucial groundwork to open the floodgates of global capital into African companies.

On top of the Herculean regulatory work, Daba will also have to dispel ingrained prejudice about the continent’s business environment. The team will have to find the right wording between transparently informing users about these markets’ real risks and dysfunctions, while also shining a light on the opportunities they represent.

Systemic corruption and politically volatile environments will be a constant in the markets Daba-listed companies operate in, and Daba will have to make the case for how the potential returns outweigh the risks. Doing so will require sharp risk analysts and an unwavering commitment to maintaining their users’ trust.

Let’s see if Boum and Anthony are up to the task. I think they are.

To learn more about Daba as a reader of my newsletter you can get early access here (referral code j4jy0mJ4pB). This is not a sponsored post but a spotlight shone on a company I believe in.

The Realistic Optimist provides weekly, in-depth analyses of some of the most relevant stories in our now-globalized startup world. Subscribe below to receive it directly to your inbox and don’t hesitate to share it with your colleagues :)