Cashea: BNPL in Venezuela

By Pedro Vallenilla

The Realistic Optimist is a paid newsletter covering the globalized startup scene.

It is read by people at Endeavor, Sturgeon Capital, Quona Capital and more.

Biography

Pedro Vallenilla is the CEO and co-founder of Cashea. Cashea is Venezuela’s first buy-now-pay-later (BNPL) app.

Launched in 2022, Cashea’s growth has been explosive. According to the company, 28% of Venezuela’s adults have downloaded the app and 1% of Venezuela’s GDP flows through Cashea. It is shooting to triple that mark by the end of the year.

Cashea users can pay for items through interest-free installments at over 4,000 merchants. Cashea takes a commission on merchants offering Cashea as a payment method (since it generally increases propensity to buy).

What is the state of Venezuela’s credit card industry, which should theoretically be your competitor?

Venezuela is a special case. It isn’t a developing country where consumer credit is a novelty. 14 years ago, when I launched my first startup, local merchants told me that 90% of transactions flowed through credit cards. When I launched Cashea two years ago, merchants told me that number had dropped below 1%.

What happened?

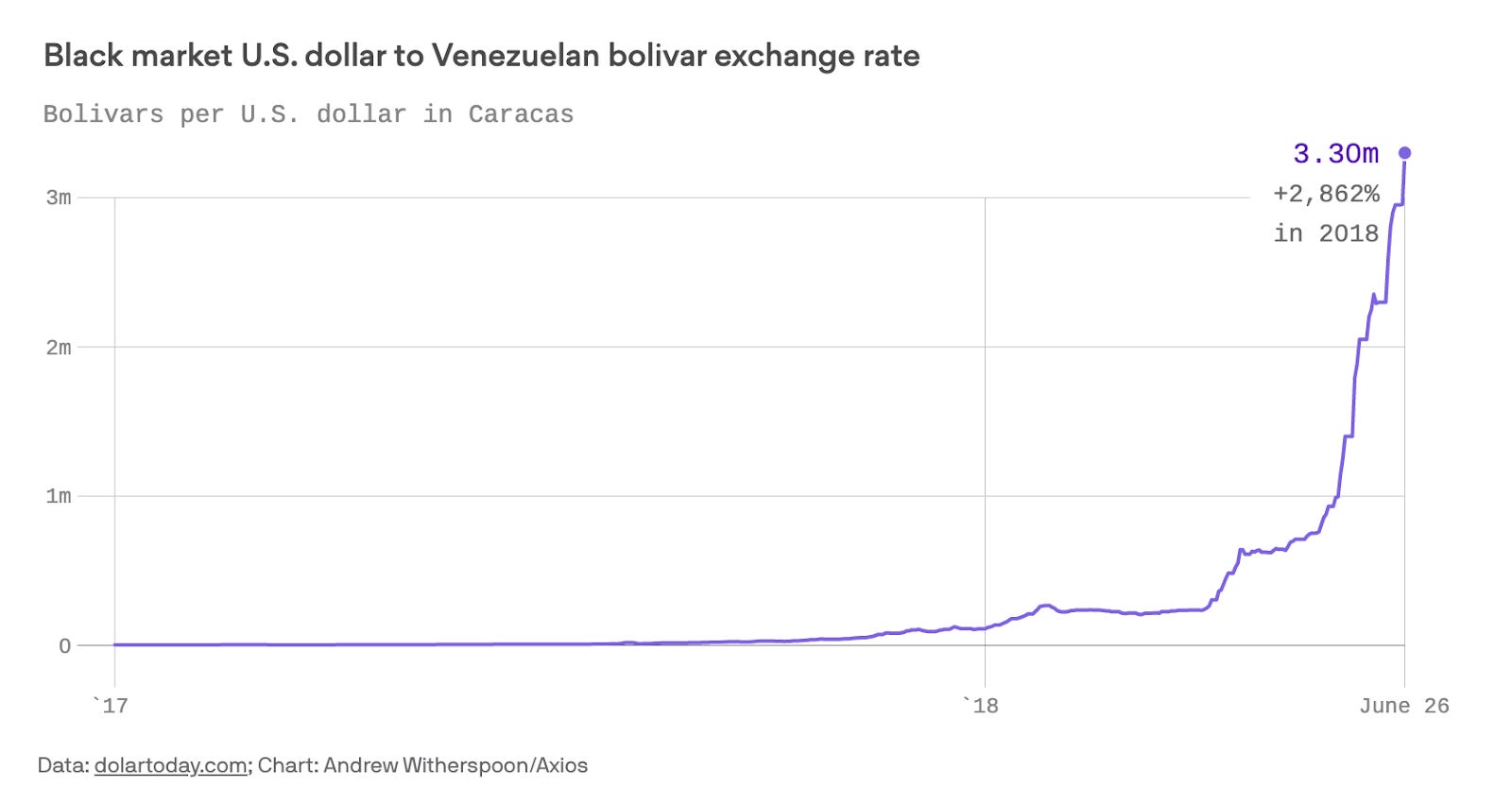

For the past decade or so, Venezuela has endured devastating economic turmoil, suffering from brutal hyperinflation and seeing its GDP reduced by 75%. The crisis was a perfect storm of policy-driven distortions, a plunge in oil prices and production, topped by sweeping economic sanctions.

Credit cards stopped making sense for banks because of negative real interest rates: interest rates were legally capped at around 28% while inflation was in the triple digits.

Imagine a Venezuelan bank issuing credit cards. The bank lends 2000 bolívares which, for the sake of argument, is worth $100. Over a couple of months, the bolívar’s value plunges. Its customer still owes 2000 bolívares, but that is now worth $30. Regulation places a cap on interest rates, so the bank can’t increase the repayment amount.

The customer pays back 2000 bolívares as planned, but it’s worth $30, not the $100 it originally lent out. The bank lost $70. Why would it continue issuing credit cards?

Recently, thanks to some reforms, the economic crash has cooled. We are even seeing small growth rates. But since the economic crisis, it has become illogical for Venezuelan banks to issue credit cards. This has created credit-starved Venezuelan consumers.

Hence Cashea’s pertinence.

Graph source: Axios (up to date figures here)

Speaking of regulation: how have you approached it?

I launched my first startup (TuDescuentón) in 2009. It was an e-commerce site aggregating daily deals and coupons. We ran into regulatory problems, which hindered our growth. I promised myself that if I launched another startup in Venezuela, I would get the regulatory aspect right.

Silicon Valley lore encourages founders to “ask for forgiveness, not permission”. In our markets, it is nonsensical. If the regulator can close your business overnight, you better ask for permission.

So we did, accepting the additional time that would incur. Our proposal was 1,500 pages long. It was rejected by the regulator four times. Our 5th iteration was the lucky one and we got the green light to launch. The whole process took around 8 months.

It was worth it a thousand times over. I’ve seen other local startups launch quickly but run into a lethal regulatory wall once they gain traction. We’d rather be alive than quick.

How have local banks reacted to your presence?

As of now, Cashea needs local banks to process payments. Users pay to dedicated bank accounts and Cashea verifies the payments. At the beginning, we painstakingly managed to convince one bank to trust us.

Things have changed. Venezuelan merchants now speak of the “Cashea effect”: customers ask store staff if they have Cashea and retailers place Cashea’s yellow logo on their window fronts to attract customers. Cashea’s growing ubiquity makes it easier for us to get banks on board. Even better, some banks are directly asking us to be included.

In terms of “competing” on credit products, Cashea and banks don’t operate in the same sphere. Local banks are also slowly opening up credit cards again, but they are targeting the top 1% of customers as a derisking measure. We’ve taken an opposite path, catering to all Venezuelans, starting with small purchasing lines and rewarding individual responsibility.

The bolívar is still weak and has been “replaced” by the US Dollar. How so?

Many prices for goods and services in Venezuela are marked in USD but the transaction currency remains the bolívar. People adapt their bolívar payment to the current USD exchange rate.

This has helped us because we’ve been able to price our installments in USD, hedging against currency depreciation. Users pay installments in their USD worth, no matter what the bolívar is worth at the time of payment.

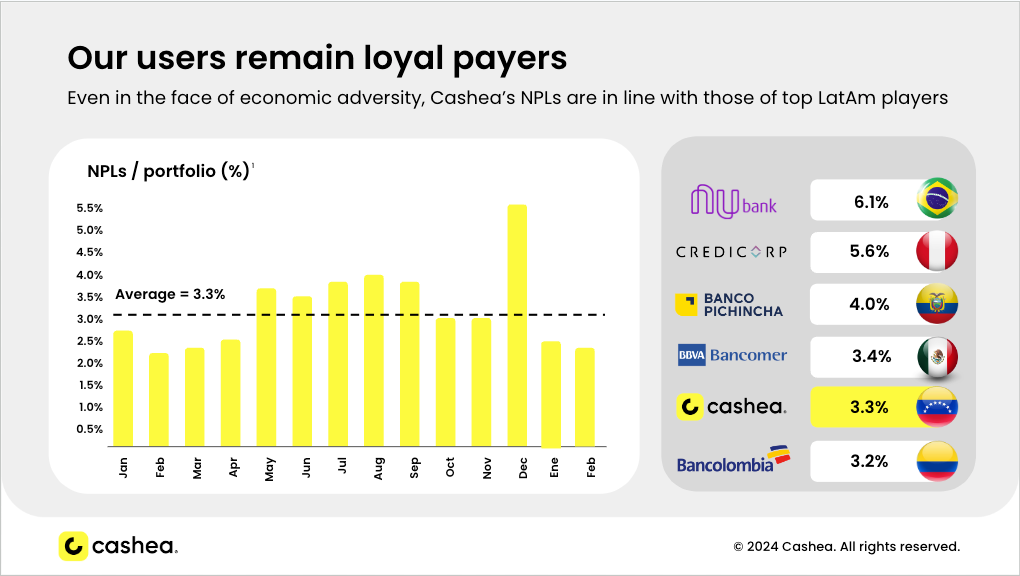

How do you keep non-performing-loans (NPLs) low? What happens when a customer can’t pay back?

This topic is close to my heart. When Covid hit, I had to close another startup I had launched. I had a wife, two kids and was riddled with credit card debt. The lights were barely on and the water was barely warm. For the first time in my life (I had always been an entrepreneur), I had to find a “real” job.

The job I found was at a debt collection startup (Colektia). The poetic justice was stark. On one hand, I had credit card companies calling me to reimburse what I owed. On the other hand, I worked at a company that helped them do that.

Surprisingly, I fell in love with the debt collection business. The experience destigmatized the negative view I had of debt delinquents, since I now was one. During my short stint there, I onboarded Nubank’s Mexico branch onto the product.

All lending products have product-market-fit (PMF), but only a few know how to collect it. I felt that launching a lending product with a debt collection background (when most founders had underwriting experience) was a comparative advantage.

So I apologized to my wife, to whom I’d promised I’d never launch a company again, and founded Cashea.

So how, concretely, do you insure low NPL?

You have to create a product that users love. Product quality heavily correlates with re-payment. If users love it, they won’t want to be banned from it. In our last two vintages, less than 1% of installments were significantly delayed. Love for Cashea’s product comes from us providing a unique service to credit-starved customers, for which they are grateful, combined with our focus on user experience.

Cultivating a respectful relationship towards users is paramount. For example, we have a battery of behavioral nudges reminding users of upcoming payments, we provide financial education to dissuade users from impulsive shopping and charge a small late fee of USD 4.

We aren’t in the business of betting on users forgetting payments and ramping up hidden fees. We are in the business of trusting, rewarding and growing with Venezuelans. This has created an engaged, responsible community.

Today, I know Cashea users pay Cashea installments before bank installments because we hold a special place in their hearts.

Source: Cashea deck

How do you make sure you lend to reliable users?

Objectively, we have very little information on first-time borrowers. We approve a large amount of users (85%) but unlock very small amounts of credit to start (between USD 50 and USD 200).

Users are rewarded with higher credit limits and lower down payments by diligently paying installments on time, every time. We give users double points if they repay 5 days before the due date. When it comes to credit scoring someone, there’s no better metric than repayment consistency.

We have other variables mixed into our credit scoring algorithm. But we primarily focus on getting a lot of people in the system, to collect data we can’t access if they are outside the Cashea ecosystem.

Why take a cut from the merchant instead of the buyer?

In a country where consumer credit is rare, we are cautious about our brand image. We didn’t want to be seen as profiteering off the lack of options consumers had. Plus, the pitch to merchants is relatively simple. Having a BNPL option generally renders higher basket sizes, which justifies our commission.

And for buyers, the pitch is powerful: buy now what you can pay tomorrow, with no interest.

Why would a merchant be reluctant to use Cashea?

Many were initially skeptical. When a merchant uses Cashea’s BNPL option, they get paid in installments as well. They don’t get paid the full price of the purchased product.

We had to convince stores to trust that Cashea would step-up if customers didn’t pay. Merchants had legitimate concerns about the quality of customers using Cashea and their ability to pay their installments. The whole concept of lending with scarce information and no collateral to low-income consumers was unsettling.

As we’ve cemented our brand and maintained low NPL ratios, this worry has dissipated.

Once we gained momentum, we were overrun by merchant demand. We have 30,000 merchants on the waitlist and we are revamping our merchant onboarding process to accept thousands every month. That says a lot about our PMF.

Why don’t you advance the payment to the merchant in full and recuperate installment payments on your end?

Because that requires a lot of funding. You need a hefty balance sheet to advance every transaction. Other BNPL companies usually raise a mix of debt and equity to do so. But we operate in Venezuela, where startup funding is almost non-existent.

That being said, Cashea’s logical evolution is providing credit to the merchants we work with. We want to enable merchants to redeem their account receivables for cash, at a premium. We are raising money for this next phase.

You recently launched the “Línea Cotidiana” product. Can you tell us more about it?

In the proverbial “West”, people use their credit cards for daily necessities. Like buying a coffee or toothpaste. Our initial vision with Cashea was to focus on longer-term, larger purchases such as a fridge. As we grew however, we got more and more demand for using our BNPL on daily necessities.

That’s why we launched Línea Cotidiana. Users can buy smaller purchases in supermarkets and pharmacies in 2 installments: one payment the day of, and one payment 14 days after. The product is inspired by what we saw Simpl do in India.

What do foreign VCs get wrong about the Venezuelan startup ecosystem?

The Venezuelan market’s potential is obscured by bad headlines and broadly worded sanctions that scare away investors. But the worst is behind it, with immense growth potential for its 28 million population.

In recent years, the ecosystem has truly transformed. The entrepreneurial vigor and energy in the country is growing. If I were to pinpoint a catalyst, it would be Yummy, one of Venezuela’s first YC startups. They’re building a “classic” superapp but are active in untapped markets (Venezuela and Bolivia). The founder, Vicente, is exceptional. He’s also an investor in Cashea.

There was undoubtedly a “before Yummy” and “after Yummy”. They kicked things off.

How do you think of international expansion?

Simply put, we’re aiming for the markets where MercadoLibre (LATAM’s e-commerce giant) is present but MercadoPago (its fintech arm) isn’t. This includes countries like Bolivia, Paraguay, the Dominican Republic…

We’re aiming to expand to two new countries by 2025. I do think there is a VC-scalable business to grow and exit by targeting these markets.

You’re personally based in Argentina, not Venezuela. Why?

I spend around one week per month in Venezuela. But the rest of the time, I am in Argentina. One of my co-founders lives in Colombia and the other one lives in Mexico. We are part of a Venezuelan diaspora that never took our eyes off the country.

Venezuela is a virgin fintech ecosystem. Cashea handles around 90% of the country’s consumer credit. To stay on top of the industry’s latest trends, we need to see what’s happening abroad. Me being immersed in the vibrant Argentinian fintech scene is a way to do so.

While we have team members in Venezuela, we actively seek out talent based outside of the country. Not because Venezuelan talent is insufficient, but rather because the ecosystem’s youth means few people have previous experience in the space. One of our co-founders (Ramón) worked at Colombian unicorn Rappi for 7 years, for example.

The Realistic Optimist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice.

More, from the Realistic Optimist:

How VCs can beat currency depreciation

Mar 28, 2024

The Realistic Optimist is a newsletter publishing exclusive opinion pieces from VCs and founders around the world.

Read full story →